That ’70s Show

As full-time investors, we are by necessity part-time historians. It is in this context that we are frequently reminded of Mark Twain’s famous line about the past: “History never repeats itself, but it often rhymes.” However, the one period that has always stood alone with no rhyming counterpart was the 1970s. Not only was the fashion of the time (bell bottoms, shag carpet, avocado colored appliances) viewed to be a “one and done” anomaly, so was the unique economic environment: oil shocks, energy shortages, runaway inflation and high unemployment. This unique period led to the creation of the term “stagflation” (the simultaneous condition of high unemployment and high inflation), which up until that point was thought to be impossible according to traditional Keynesian/Phillips Curve economic thinking.

Indeed, in the four decades following, we experienced a number of long economic cycles, characterized by low and relatively stable inflation and healthy economic growth. Notwithstanding Mr. Twain’s pearls of wisdom, the 1970s have come to be thought of as the unicorn of our modern economic times, (talked about but never seen) until now. With $100+ oil prices, shortages of a whole host of commodities and product components, and CPI inflation running at 8%, we already have the inflation part of the equation. We also are experiencing tightening financial conditions, the beginning of a Fed rate-hiking cycle, fiscal spending in retreat, and consumers and businesses increasingly fretting about higher prices, which combine to portend a slowdown or stagnation in growth. Toss in a Cold War-esque conflict with the modern equivalent of the Soviet Union, and you may feel like you’ve stepped into a time machine and walked out into a mirrored-ball disco palace.

So, is it time to put on those Jordache jeans, break out that Bee Gees album, flip on an episode of The Love Boat or Mary Tyler Moore Show, and get your ’70s groove on?

Before answering that question directly, let’s review some of the conditions that have provided the opposite of stagflation (low inflation with solid growth) for the last 40 years:

- High labor force growth in the U.S. supported by baby boomer demographics, strong immigration, and increasing participation of women in the workforce

- Opening up of emerging market labor forces for global manufacturing

- Increasing global trade, which allowed for the production of cheap goods abroad to be imported to the U.S.

- Increasing use of technology and automation, which boosted productivity and lowered the demand for labor

- Relative peace and tranquility among major global superpowers, which provided a stable geopolitical backdrop for global commerce

This “Goldilocks” set of conditions led to an abundant supply of labor and materials and flourishing global competition. The result was low inflation, central banks that could (and did) respond aggressively to negative economic and financial shocks, and a multi-decade period of lower and lower interest rates and higher and higher asset prices.

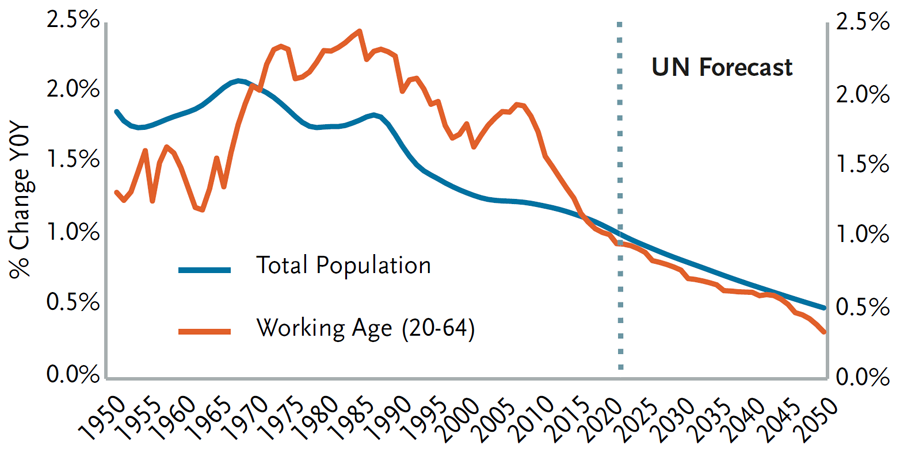

If that is where we’ve been, where are we now and where are we going? There are definitely causes for concern and reasons to think we might all be doing The Hustle in the not too distant future. Many of the trends that have brought us a low wage growth environment are changing. Demographics, that slow moving evolution of the population – birth to working age to retirement to death – is moving from friend (working age population growing faster than overall population) to foe. And it’s not just the U.S., Japan, and Europe, it’s the majority of Emerging Markets too. Observe the following chart of the working age population across the globe:

Working Age Population Growth Decelerating

Source: United Nations

Partly impacted by changes brought on by the global pandemic, recent trends in immigration and labor force participation among working age people suggest that some of the labor force tailwinds are turning to headwinds. This not only implies lower potential GDP growth in the years ahead, but has the potential to be inflationary as well, particularly if the non-working part of the population is growing disproportionally and generates strong demand for products and services due to government support/transfer payments and/or the liquidation of wealth that has been accumulated during the bull market of the last 40 years.

The recent trend in global trade and geopolitics is also somewhat worrying from an inflationary standpoint. Even before the pandemic heightened tensions with China, the U.S. had started to readdress its economic relationship with China by taxing trade (via tariffs) and restricting the transfer of intellectual assets (technology). Trade with China had already begun to slow pre-2020, but the pandemic, specifically the supply chain bottlenecks that resulted, have highlighted the need for companies around the globe to simplify supply chains and bring production closer to home, especially for those products deemed to be critical to national and medical security. If expanding global trade fostered the production and distribution of cheap goods and services, it would seem to be logical that a partial reversal might lead to more expensive goods and services.

Geopolitics is always a wild card, and the initial months of 2022 are certainly living up to the “wild” part. While it is still unclear how long and severe the disruptions from Russia’s invasion of Ukraine will be for the global economy and markets, the near term impact is clear and not particularly good: massively higher energy prices across the globe and particularly for Europe, as well as upward pressure on prices for industrial metals and grains that are also exported from that region, have clear stagflationary implications in the near term, both reducing demand and increasing inflation.

So, is that it – are we back to the dark days of the ’70s? Our answer: “yes” and “no” (nice hedge, huh?). “Yes,” there is no doubt in our minds that 2022 and even 2023 will see elevated inflation, slowing growth and the strong potential for recession. Even if the Fed fulfills the market’s expectation of 6-7 hikes, the price pressures in the economy are broad based and are spread throughout the labor market. As Fed policy works with a lag on the economy and inflation lags economic activity, we could be looking at a misery index (inflation plus unemployment – remember that from the ’70s?) in the low double digits soon.

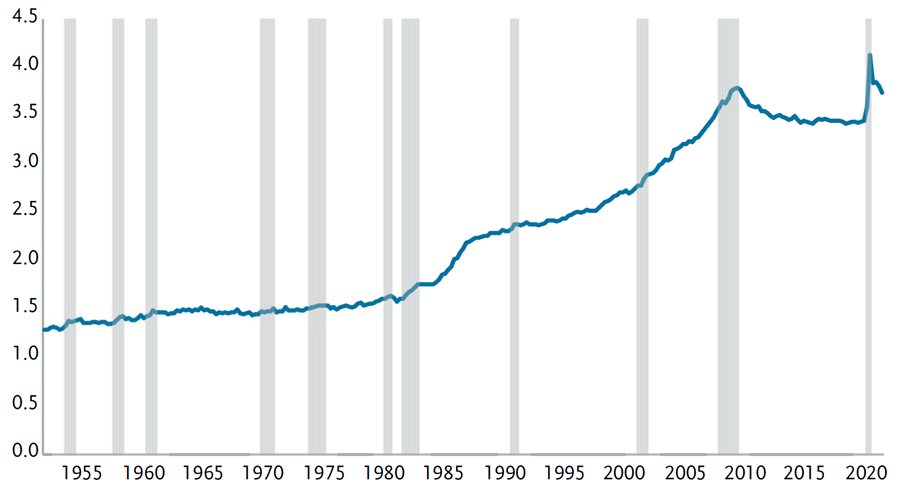

However, our long-term (3-5 year) view is “No,” we do not think a 4+% inflation rate is sustainable in the U.S. for a prolonged period of time. While technology and automation will continue to be disinflationary forces that limit labor getting too much of the upper hand, our main reason for doubting the long-term sustainability of high inflation is a four letter word: D-E-B-T. We have a lot of it, across all three segments of the economy (government, businesses, and consumers). As the chart below highlights, combined debt is at an all time high relative to the size of our economy (3.5X). This means that the higher interest rates that come with higher inflation will have a harsh impact on the economy – government budgets get squeezed by higher interest payments, while highly leveraged consumers and businesses become stressed, forcing many into default. In other words, things will break and demand will be negatively impacted in a high inflation and high interest rate environment.

U.S. Total Credit Market Debt*

Source: Board of Governors of the Federal Reserve System

*Includes government debt, household debt, and corporate debt.

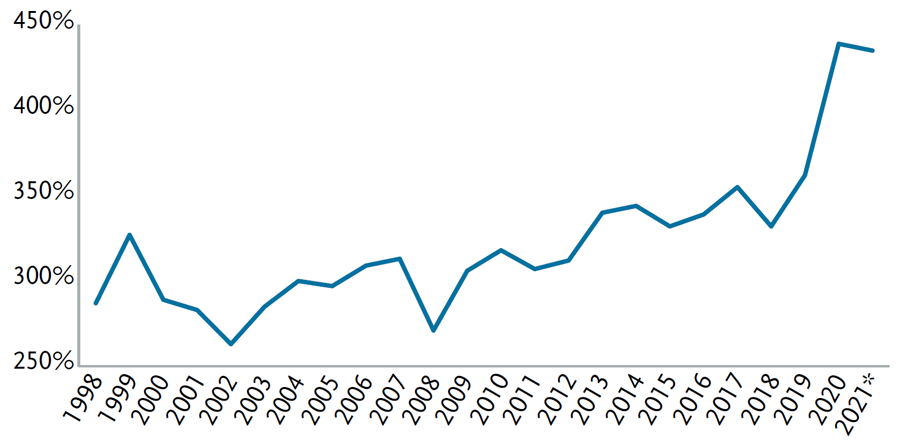

In addition, our economy is increasingly tied to the well-being of the capital markets, as illustrated by the chart below, which shows the ratio of financial assets relative to the economy. In today’s world, not only do financial markets reflect investors’ aggregate predictions of the future, but the movement of asset prices themselves will more than ever influence the economic future by impacting wealth and spending. To spell it out... higher inflation → higher interest rates → lower assets prices → lower demand for goods/services → slower growth and less upward price pressure.

Value of U.S. Stocks and Bonds as % of GDP

Source: SIFMA, Bloomberg

*As of 9/30/2021

What does all of this mean for how TCW will be managing your fixed income assets?

- Inflation volatility will be high and right tail inflation risks are elevated. Investors need to be paid a premium for this uncertainty. Term premiums should be higher and the yield curve steeper than it is currently.

- Long-term Treasury yields should average in the low-to-mid 2% area, and a value approach to managing duration around that level will be additive to portfolios.

- The risk of monetary policy error (too tight or too loose) is high and credit spreads are likely to widen in either scenario. The disciplined adding of high quality corporate and securitized credit into this widening environment will continue to be accretive to long-term portfolio returns.

And finally, what does this mean for your wardrobe decisions? Well, we’d suggest that it might be okay to sport those bell bottoms for a while, but don’t get too attached because, just like the short three year time period covered by the nostalgia T.V. series That ’70s Show, it won’t be too long before those bell bottoms are back in that bottom drawer.

Disclosure

This material is for general information purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any security. TCW, its officers, directors, employees or clients may have positions in securities or investments mentioned in this publication, which positions may change at any time, without notice. While the information and statistical data contained herein are based on sources believed to be reliable, we do not represent that it is accurate and should not be relied on as such or be the basis for an investment decision. The information contained herein may include preliminary information and/or “forward-looking statements.” Due to numerous factors, actual events may differ substantially from those presented. TCW assumes no duty to update any forward-looking statements or opinions in this document. Any opinions expressed herein are current only as of the time made and are subject to change without notice. Past performance is no guarantee of future results. All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. © 2025 TCW