Where's Jerome?

Sometimes the answer is right under our nose but our recency bias conditions our

expectations and clouds our better judgement. To be fair, 15 years of conditioning

could distort even the sharpest of senses. For some, it’s been an entire career. For

us old (-ish) timers, it’s a good half of it or more. How did markets behave before

an $8.7 trillion dollar Federal Reserve balance sheet? Before central banks threw

an alphabet soup of 13(3) programs at each liquidity crisis? Before a 4% mortgage

rate sounded expensive and before the easiest (and most profitable) trade was to

merely sell volatility and buy the shallow dip? One could easily forgive those who’ve

thrown in the towel – tossed the financial analysis in the trash and simply grinned

through the holes in a covenant package knowing they had the Bernanke, Yellen,

Powell put and, most recently, an $8+ trillion spending spree from Uncle Sam to

ensure nothing short of a sharp “V-shaped” recovery from the early months of the

pandemic. Rather than forgive, perhaps congratulations are in order? Let’s face

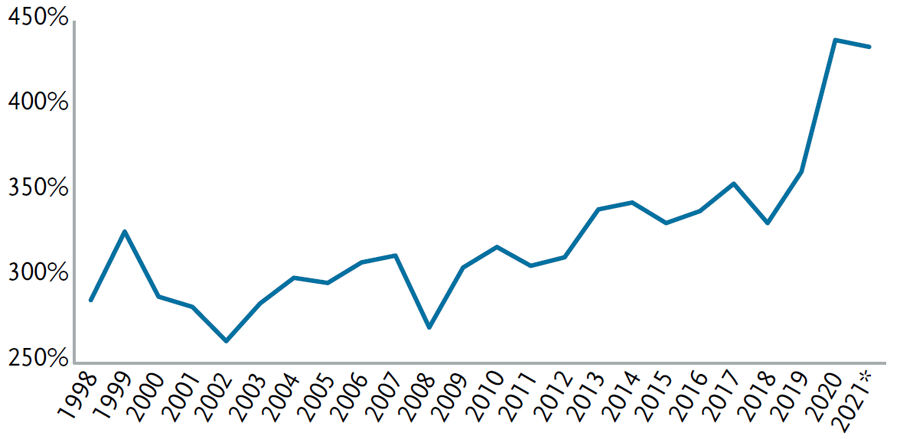

it, we work in a results-driven business and regardless of the how or why, riding the wave shown in the chart below is the only thing that has mattered. Of course stocks and bonds were by no means the only

beneficiaries of the one-way train in asset prices – so extra credit to all those wise enough to hold some combination of real estate,

commodities, crypto, NFT’s, meme equities, precious stones, art, used cars, and….well…..you get the idea.

Value of U.S. Stocks and Bonds as % of GDP

Source: SIFMA, Bloomberg

*As of 9/30/2021

While the wave has made the pockets fatter, we fear it has come at the expense of the senses now being a bit duller. Now, hold on, I promise, this isn’t the part where your bond manager rants and raves about unsustainable levels of debt. Or about bond holder protections looking more like a slice of Swiss cheese than fiercely negotiated contractual terms, or about 7x (cough, cough) levered obsolete companies soaring like eagles, borrowing money at 5%, all the while gobbling like turkeys during quarterly earnings calls. Don’t get me wrong, we’ll continue to spill ink on those topics as we work hard to be your eyes and ears on the front lines of the capital markets, but today we’d rather discuss what has enabled such a successful run of asset price targeting from the largest global central banks.

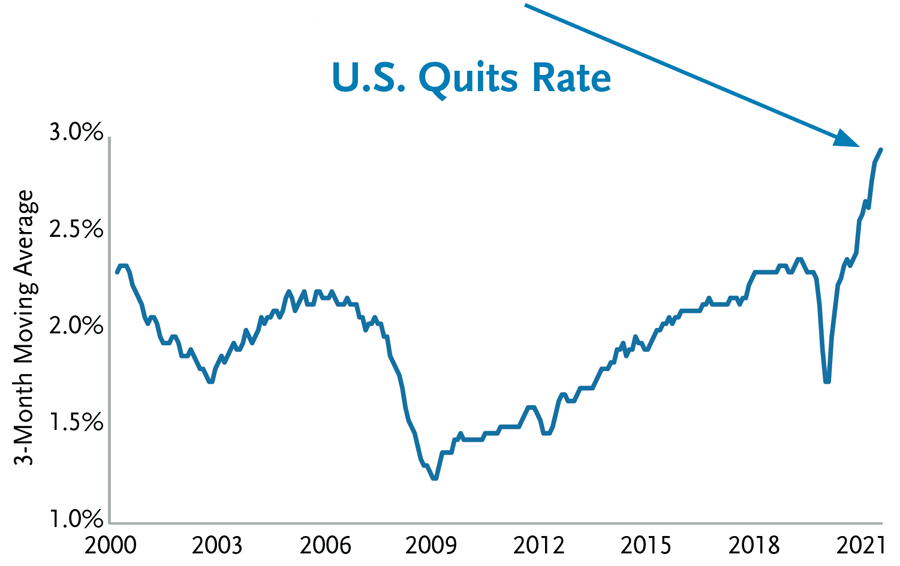

We are of course referring to a secular run of low and stable inflation that has provided ample cover to fire round after round of monetary ammunition, all the while continuing to meet (or, for that matter, never having to worry about exceeding) inflation objectives. The tailwinds of technological advances, trade globalization, and aging demographics on inflation resulted in the almost annual awarding of “Participation Trophies” for every major central bank. And who could blame them? If an “easy” button lands on your desk, you push it! Let’s leave the debate over if, when, and how quantitative easing and low/zero rates were used for another day. Rather it’s a far better use of our time to assess what monetary policy will or won’t be and how markets will respond. So, while the secular tailwinds still blow, albeit some at a more modest pace, we’re also witnessing the headwinds of supply chain disruptions, strengthening labor power, and ample consumer demand for goods on inflation. This dynamic, not seen for decades, is complicating monetary policymakers’ ability to meet inflation objectives while keeping both hands on the wheel of financial conditions. Our central banks are going to have to earn their trophies in 2022 because easy is over and investors need to prepare.

Now this is the part where we’re supposed to label inflation “transitory” or “enduring,” where we prognosticate when the Fed will first raise rates and how many times thereafter, when we pinpoint the month the balance sheet will start to shrink and at what pace, and of course (who could forget) what the yield will be on the 10-year Treasury at year’s end. Alas, you’ve come to the wrong thought piece for that, but please, stick with me for a bit longer. We don’t write in certainties because we don’t invest with certainties.

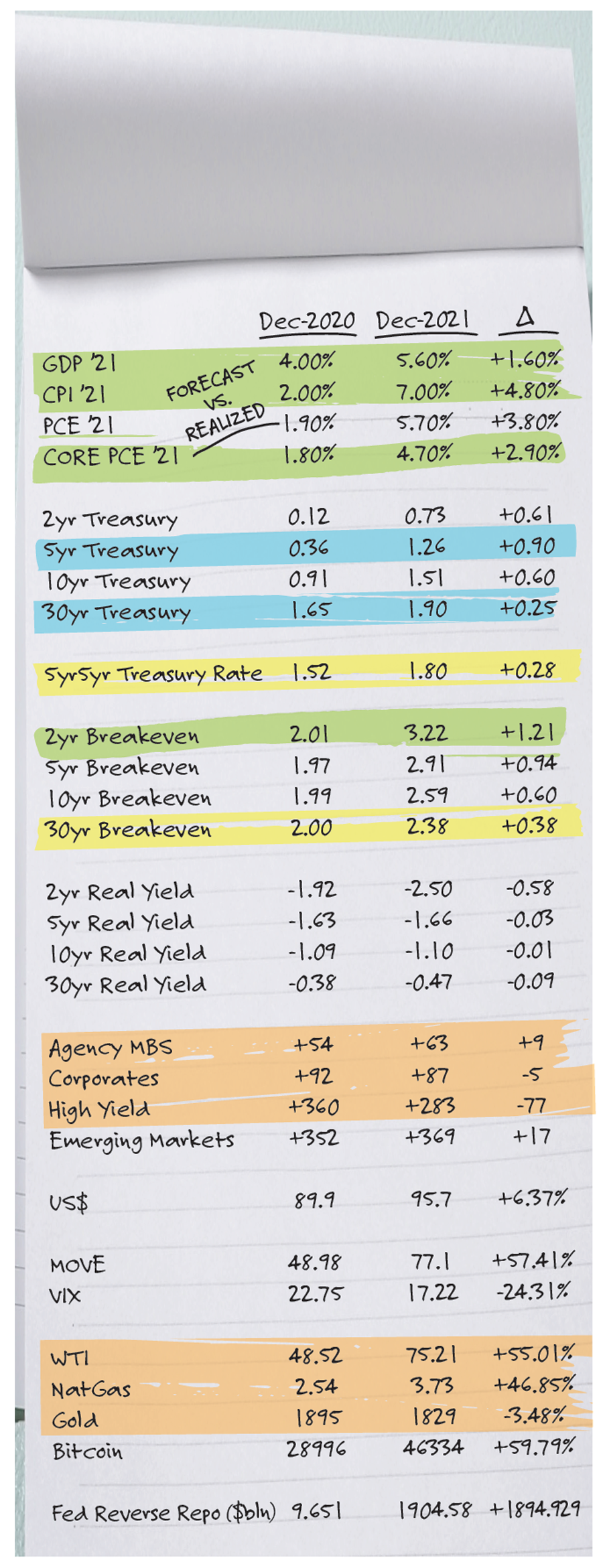

Instead, we view our job to be disciplined pricers of risk. As such, let’s take a look at a “dashboard” of market movements and prices and infer the global investor’s collective expectations. We’ll start with the green highlights and make the simple point that while the economy did experience the anticipated strong real growth, the market got the inflation narrative wrong. Two-year breakeven inflation expectations started 2021 at 2.01%, reflecting a belief that the upward pressure from base effects and supply chain disruptions on inflation would “burn off” in the second half of the year. Rather, the blue highlights illustrate a change in the market outlook as the yield curve bear flattened, anticipating earlier rate hikes from the Fed to address higher realized inflation as well as increasing near term inflation expectations. However, as the narrative shifted from merely a supply chain problem to a wage problem as labor’s bargaining power grew,

Source: BLS

longer term instruments highlighted in yellow such as 30-year TIPS (and the expected long-term inflation rate embedded in it) showed remarkably little movement over the second half of 2021. This implies a high degree of confidence that the Federal Reserve will deliver just the right amount of tightening, using the right mix of rate hikes and balance sheet reduction, at exactly the right time to manage an inflation problem they had misdiagnosed a mere two months earlier.

We can look to the credit, equity, and commodity markets in orange for further confirmation of Fed faith and a “risk-on” bias. While Agency MBS spreads have continued their widening and underperformance (largely reflecting expectations of the end of quantitative easing), spreads of investment grade and high yield corporate bonds not only tightened in 2021 but remain near all-time lows. Commodities like oil and natural gas at recent highs, along with equities near all-time highs, tell a similar story as do traditional “tail” hedges like gold underperforming their more cyclical counterparts.

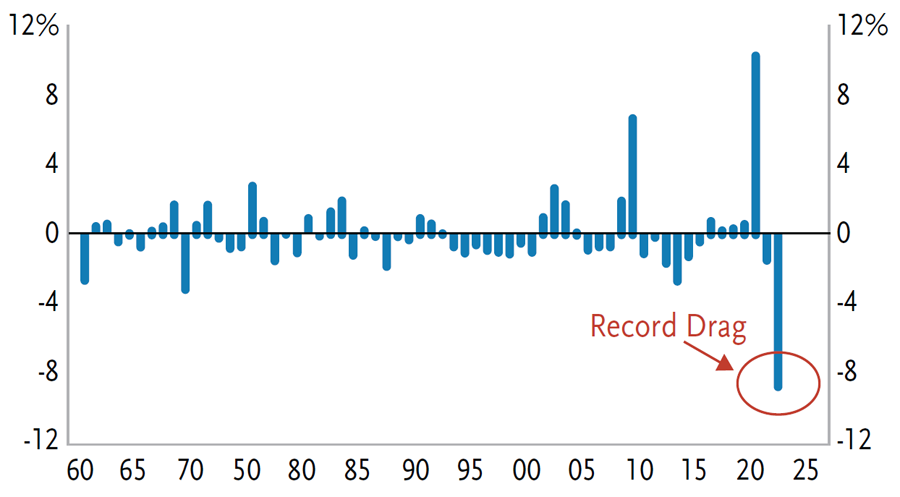

Could the Federal Reserve meet the market’s current expectations and deliver a dose of monetary tightening neither too hot nor too cold but just right to manage the unexpected bout of inflation while also calibrating to a massive year-over-year withdrawal of fiscal stimulus?

Fiscal Impulse

Source: Natixis, CBO

Of course they could, but investors need to ask themselves if they are being compensated for the chance they don’t. Truth is, while we believe odds favor a long-term reversion back toward 2%, we can’t tell you with certainty who will win the long game of this inflationary tug-of-war between the secular disinflationary tailwinds on one side and supply chain and labor power headwinds on the other. What we can say with conviction is that we have the biggest inflationary tail risk in 40 years creating the most significant challenge for central banks in a generation. It would appear the Fed knows easy is over but the markets don’t seem to be listening. The answer to portfolio positioning is right under our noses. We need merely to shake off the cerebral rust built up over the past 15 years to see it. In the possible but unlikely event the Fed happens to land this bird safely, an aggressively positioned bond portfolio, reaching for every last drop of yield, isn’t much more than a coupon clip as spreads don’t have room to tighten much further. If the monetary tightening in 2022 exceeds current expectations, if inflation strengthens and the Fed is deemed to be “falling behind the curve,” or if organic growth is unable to fill the gap left by the 2022 fiscal drag (or any combination of the three) there will be investment opportunities well in excess of the meager yield you see in the bond market today. You’ll be glad you kept your powder dry, my friends. Volatility is likely coming one way or the other.

Disclosure

This material is for general information purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any security. TCW, its officers, directors, employees or clients may have positions in securities or investments mentioned in this publication, which positions may change at any time, without notice. While the information and statistical data contained herein are based on sources believed to be reliable, we do not represent that it is accurate and should not be relied on as such or be the basis for an investment decision. The information contained herein may include preliminary information and/or “forward-looking statements.” Due to numerous factors, actual events may differ substantially from those presented. TCW assumes no duty to update any forward-looking statements or opinions in this document. Any opinions expressed herein are current only as of the time made and are subject to change without notice. Past performance is no guarantee of future results. All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. © 2025 TCW