Back in the US... Back in the USSR

Author: Tad Rivelle

The inefficiencies of that ultimate state planned economy – the former Soviet Union – were eminently lampoonable. One of former President Reagan’s went this way:

A man walks into a Moscow car dealership and hands over his rubles to the car salesman. The beaming salesman exclaims, “Congratulations on buying your new car. I am scheduling it for delivery exactly ten years from today.”

The buyer, suddenly distraught, quizzically probes: “Ten Years?! – well…is that going to be in the morning or the afternoon?”

The salesman, now perplexed, replies: “Comrade – this is ten years from now – what difference does it make if the car is delivered in the morning or the afternoon?”

The buyer raises his voice and shouts, “Well, I have the plumber coming in the morning!”

Notwithstanding employing armies of well-educated central planners, such economies failed in their ability to deliver what consumers needed. Shortages were widespread and endemic. This is all understandable: the planners were being asked to solve for the impossible. The job of the planning bureau was to set prices and production targets. But as every undergraduate student of economics knows, you cannot simultaneously fix both the price and the quantity of anything. The attempt to do so led to a hopelessly tangled and confused system. In contrast, free market economies seek efficiency by respecting individual preferences. When all is working as it should, the “right” price is solved for, and shortages (or surpluses) are rapidly corrected. You are never supposed to go to the store and find empty shelves, or be told that what you want can’t be delivered for months or years.

The riddle for the day then, is why is our “free market” economy experiencing shortages across a wide variety of goods and services? Shoppers for new cars arrive to find the dealerships out of inventory. Want to upgrade or improve your home? Good luck getting the windows or doors that you want. Businesses struggle to hire workers even as millions remain in the ranks of the unemployed. Wait times for appliances, running shoes, and holiday gifts have “inexplicably” lengthened. Why?

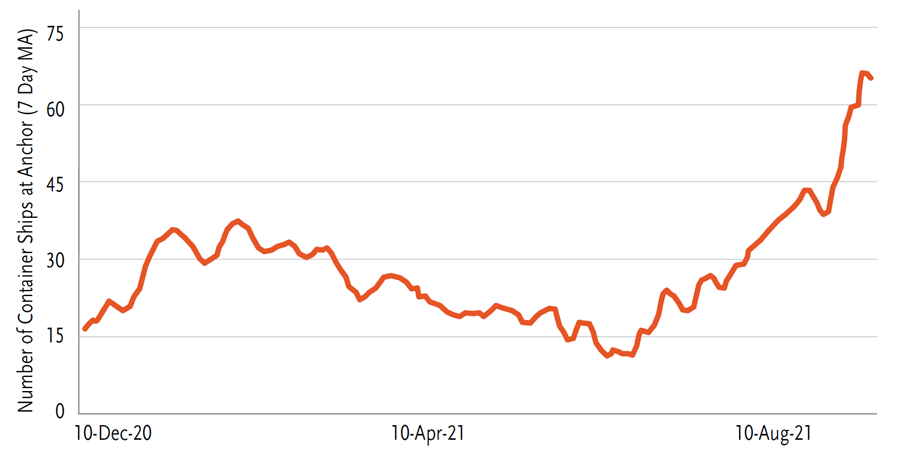

The conventional “explanations” are as plausible as they are superficial. Yes, there are COVID restrictions. And supply chain issues. Also social pressure to decarbonize via the curtailment of fossil fuels. These obviously do constrict supply. The deeper question is why hasn’t the price mechanism corrected for these? Historically, supply constrictions have occurred owing to bad harvests, labor strikes, political disruptions, or trade embargoes. But reductions in supply should jack up prices thereby restraining demand and, eventually calling forth new sources of production. But here we are, closing in on the two year “anniversary” of the pandemic, and the shortages remain. Indeed, using the proxy in the form of shipping congestion, these shortages may be worsening.

Los Angeles/Long Beach Port Congestion

Source: MXSOCAL, Bank of America

The difficulties in balancing supply with demand suggest there may be deeper reasons for the imbalance. Like what? Let’s try this one on for size: perhaps the U.S. economy has taken on some nascent characteristics of a centrally planned economy because it has implemented policies that are more at home in a state driven economy than a “free” market. Indeed, as all well know, the constellation of fiscal and monetary policies implemented under COVID have dramatically kicked up the economic role of the state. Federal spending has gone into overdrive even as the Fed brought asset purchases to new levels. While this was all done in the service of stabilizing the macroeconomy, there can be too much of a “good thing.”

The demand side of the economy has been well fed by these policies, so much so that the supply side isn’t – and can’t – keep up. Year-over-year conventional inflation metrics are running above 5%, even as the shortages suggest further upward price adjustments may be needed to balance supply and demand. Importantly, it isn’t like the supply side isn’t expanding: oil may well be at $80/barrel (at the time of this writing), still global output is expected to rise at a respectable 4% pace in 2021. Employment continues to expand, yet millions of positions remain unfilled.

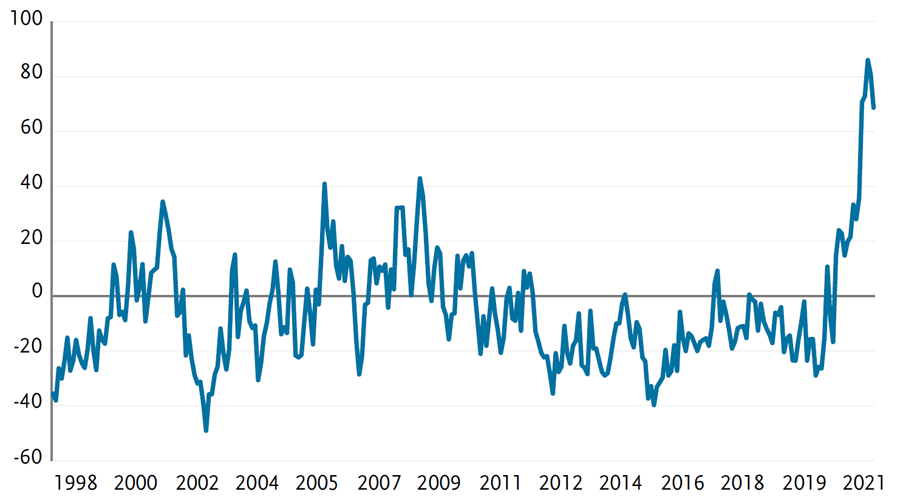

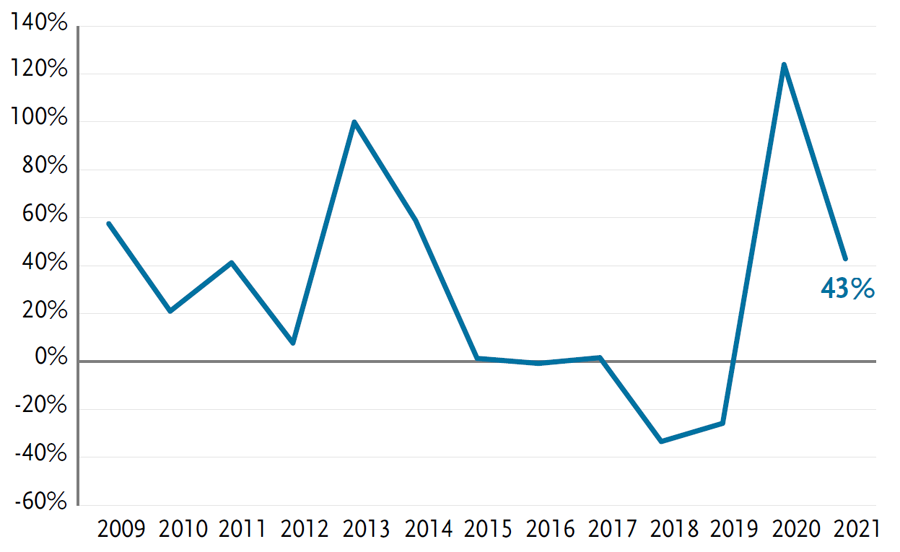

If this thesis is correct, then the question of whether today’s inflationary uptick is “transitory” may very well depend upon how “transitory” the pandemic motivated expansion of the state’s footprint turns out to be. Already, conventional inflation metrics indicate a rate in excess of 5%. Tellingly, the Citi U.S. Inflation Surprise Index signals that inflationary conditions are worsening at a rate higher than expected by investors and pundits alike:

Citi U.S. Inflation Surprise Index

Source: Bloomberg

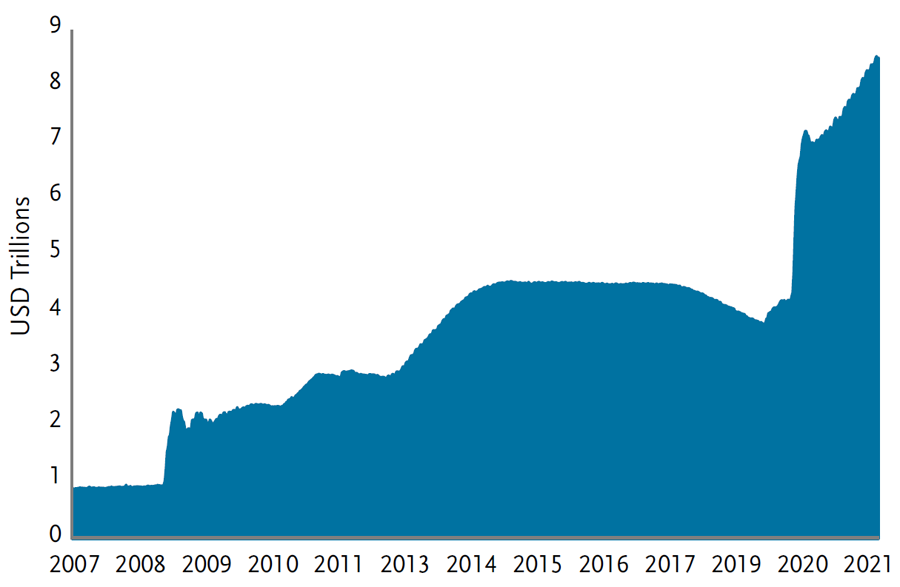

To probe the question as to whether today’s market dysfunctions are in fact a direct product of excessive stimulus, note the near asymptotic rise in the size of the Fed’s balance sheet juxtaposed with the observation that nearly half of all the “risk-free” debt being issued (mainly Treasuries and Agency MBS) have been gobbled up by the central bank:

Fed Growth of Balance Sheet

Source: U.S. Federal Reserve

Fed Share of Risk-Free Borrowing*

* Net Fed purchases of U.S. Treasuries and Agency MBS bonds as a

percentage of aggregate net issuance.

Source: SIFMA, Deutsche Bank, Morgan Stanley, TCW

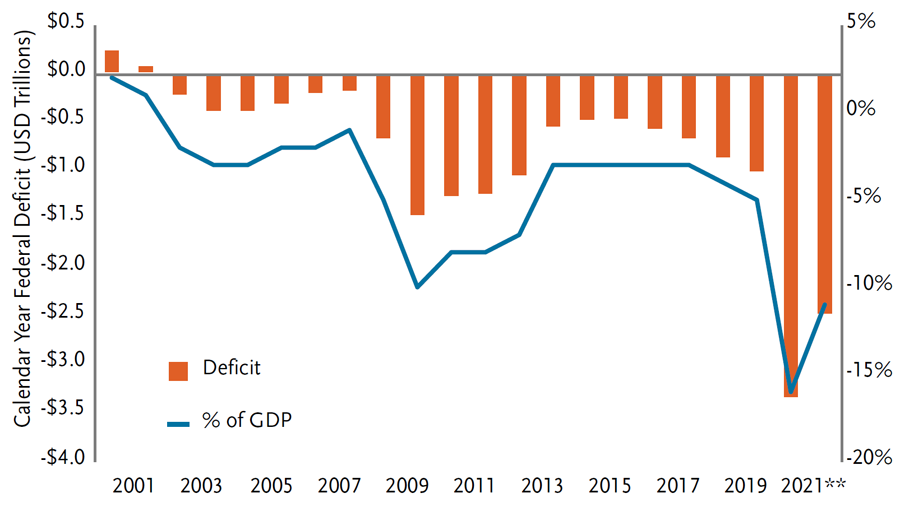

Of course, all this buying of debt by the Fed has enabled a massive spending surge by the national government. Ordinarily, so much borrowing would pressure rates higher, causing private sector demand to moderate. With a little help from its friends at the Fed, all this borrowing is accomplished without making credit more expensive.

U.S. Federal Deficit and as a % of GDP

Source: BEA, TCW

** Bloomberg and CBO projections used for the last four months of 2021.

In effect, while the U.S. is not engaged in anything like Soviet style “in the weeds” microeconomic central planning, the policy regime in place now is a kind of macroeconomic driven central planning that has dissociated demand from supply in some fundamental ways. Both the quantity and pattern of spending throughout the economy has been realigned by political direction, even as the financing of this spending has been untethered from market constraints. Indeed, some one trillion dollars per year in Treasury debt alone is simply being journalled from the U.S. Treasury’s balance sheet onto that of the Fed. The Fed is not a market buyer of securities – it is a quantity buyer and, as such, its transactions are “off market.”

Ongoing suppression of market rates by the Fed adds a further dimension to an increasingly uncoordinated economy. The Fed has, in effect, redefined its mandate to that of enabling the turning of the fiscal spigots, suppressing market interest rates and elevating asset prices. The Fed has long ago ceased being the adult in the room who took the punchbowl away. While none of this is exactly a newsflash, the sheer scale of policy implementation has inflated incomes (via transfer payments) in a manner that is non-market. Essentially, the traditional role of interest rates as the coordinating mechanism between, for instance, capital goods and consumption, has been disabled. Meanwhile, inflated asset prices provide the collateral against which credit can be unnaturally expanded creating new spending power today at the risk of heightened vulnerabilities tomorrow.

So, where does this leave us investors? Well, to be fair, it may be the case that U.S. policy may move in a more market friendly direction in 2022. Already, a certain amount of fiscal tapering – supplemented by monetary tapering – may represent a partial backing away from this expanded governmental presence. Should that happen, and recognizing that one of the consequences of inflation is also diminished purchasing power, we might see a period where demand moderates, and shortages rehabilitate.

Another possible direction is that a slowing economy is championed by the politicians as a reason to double-down on stimulus. Hence, “rinse – cycle – repeat” is an alternative possibility for 2022. Should the politicians take us down that road, i.e., more of the same in terms of policy, expect more of the same in terms of results: shortages, more inflation.

The upshot, then, boils down to the basic market reality that 10-year Treasury securities at or around 1.5% do not represent fundamental “value” in a 5% trailing inflation environment. More stimulus is not likely to be taken kindly by bond investors already suffering a loss in purchasing power. Policy has painted itself into a corner: adding more demand may not so much counteract an economic slowdown as it might add to inflation and promote a market protest in the form of higher rates. But, how might the economy re-coordinate itself unless it is given a chance to hold its breath and rebalance? Markets do have a way of making fools of all, and perhaps a way out will be found. That said, a growth slowdown owing to moderating stimulus or, alternatively, a step further towards stagflation would seem to be the likeliest scenarios going into the new year.

Disclosure

This material is for general information purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any security. TCW, its officers, directors, employees or clients may have positions in securities or investments mentioned in this publication, which positions may change at any time, without notice. While the information and statistical data contained herein are based on sources believed to be reliable, we do not represent that it is accurate and should not be relied on as such or be the basis for an investment decision. The information contained herein may include preliminary information and/or “forward-looking statements.” Due to numerous factors, actual events may differ substantially from those presented. TCW assumes no duty to update any forward-looking statements or opinions in this document. Any opinions expressed herein are current only as of the time made and are subject to change without notice. Past performance is no guarantee of future results. All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. © 2025 TCW