Process Makes Perfect

Author: Tad Rivelle

According to Greek legend, Athena – the goddess of wisdom – emerged from the head of Zeus fully grown and fully armored. Unlike Athena of wisdom born, investment teams and processes do not burst forth, fully formed, but rather accrue their wisdom over many market cycles from the school of hard knocks. Were it otherwise, first rate computer models perfected by teams of data scientists assisted by Finance PhDs would have Mr. Market’s “number,” hands down. Why does the Holy Grail of that ultimate, virtual portfolio manager remain so elusive?

In a word, it is that markets are nothing more nor less than the human element writ large. Capital market pricing may tend towards rationality over long time periods, but in moments of crisis and panics, pricing is only as rational as the crowds who determine them. Markets are also adaptive and don’t just sit still while they are being “psychoanalyzed.” Hence, investment success speaks less to how complete your knowledge set is, and much more to how a team wields its experience in putting what knowledge it has to work in the moment in which it matters. Shakespeare, always a fellow who had a way with words, put it thus: “There is a tide in the affairs of men. Which, taken at the flood, leads on to fortune; omitted, all the voyage of their life is bound in shallows and in miseries.”

Implementing an investment process when the seas are calm tends to be a straightforward task. The difference in results between a “good” investment decision and a “mediocre” decision is often limited. In fact, irrational risk return tradeoffs often empirically pay off and their sponsors can look like geniuses …until they don’t. Moreover, decision making in times of low volatility need not be hurried and analysis can be prioritized over action. Material disagreements over investment decisions are fewer and further between, and consensus thinking tends to dominate. In short, a computer model might just be able to act as a “stand in” during such times given that the investment process is more administered than led when the waters are becalmed.

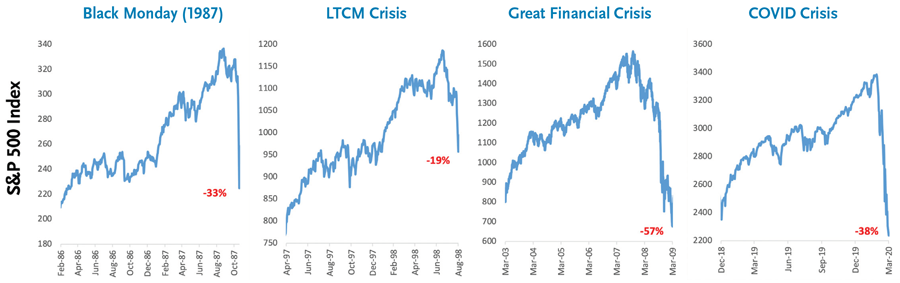

And what of times such as March/April last? Exactly how does an investment process cope with a confluence of circumstances that no one has ever seen before? The answer lies in experience and a belief in the process and the disciplines in which it is grounded. All market crises are different and yet at their core are the same primeval elements: Phobos and Deimos. During such times, rumor and information merge into a single undistinguishable clump. In these information vacuums, what seemed rational now seems uncertain, traditional valuation models cease to predict pricing and risk measures considered reliable fail. Investors quickly become overwhelmed and fear dominates: “contagion” is the watchword, and investors begin imagining what could go wrong next. It is the human element that causes these breakdowns and each one has its own psychology and rhythm.

Under such circumstances, investment processes that had been merely “administered” rapidly break down. Investment committees cannot find consensus, or when they do, the consensus merely reflects the fears of the very participants who need to be masters of the process. Single individual CIO governance does not work well either. The flood of information and the sheer quantity of decisions which must be made while all is engulfed in darkness and uncertainty “saturates” the cognitive capacity of any one person. And, yet, it is during these periods of extreme volatility that an investment process must prove its mettle, protecting client capital during the panic phase and distinguishing between investments that will break versus those that will “merely” bend in the chaotic crisis phase.

When Things Go Wrong, They Go Wrong All at Once and Without Warning...

Source: Bloomberg, TCW

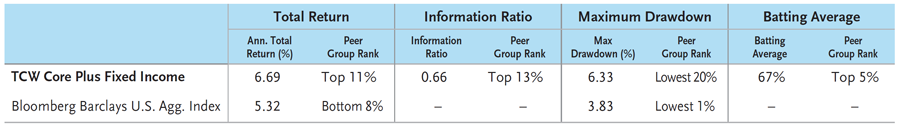

Having learned and hopefully garnered some wisdom over many cycles, our team that manages the MetWest and TCW fixed income portfolios has identified some key ingredients that an investment process must embody if it is to account for the market’s human element.

First, there needs to be an awareness that “administrative” skills will not carry an investment process through a time of crisis. While the term is ill-defined, it is the team’s collective leadership skills and experience that determine whether the ship sails, or is alternatively relegated to the miseries of the “shallows.” Whereas good “administration” practically epitomizes formula, repetition, and reasonableness, “leadership” embodies decision-making “under fire.” Adaptability, awareness, and commitment to stand by the process are the “skills” needed during such times. Many decisions undertaken during these “moments” are necessarily highly uncertain and the team has little choice but to act boldly based on experience and the disciplines learned through previous market crisis for the long-term benefit of investors. However, in the moment this wisdom is seldom apparent. The reality is that few would regard an investment team that is adding risk while trillions of dollars are desperately seeking safety as “prudent.” Fewer still might regard a team that continued to add risk in the face of further price erosion as “reasonable.” In short, the search for the “median” opinion is decidedly not what an investment process must be during such times. Rather, understanding what the process “demands” becomes the essential feature.

So, how does the investment process get “perfected?” It doesn’t. The investment process does not originate from “some” Zeus’ design. Rather, the process represents the result of an ever-evolving, continually improving dynamic. As such, the team leaders must recognize their own limitations and accept their cognitive foibles, so that the “right” lessons get learned and the wisdom that is the process expands. In the language of Japanese business culture, the process “kaizens.” Over time, the team leaders’ decision making incorporates not just an expanded data set, but also wisdom, imagination, and logic.

Source: eVestment, TCW

Note: All performance measures displayed are calculated using monthly returns, 8/1/1996 - 12/31/2020.

Our team has been fortunate too, for there is wisdom in recognizing the “joker” always lurking somewhere in the deck of cards. Still, on this one year anniversary of a truly unique market crisis, followed by perhaps the strangest recession ever seen, we thought it appropriate to both thank the many who have voted their confidence in our team and to remind you as well as ourselves that, in the words of Eddie Cantor, it takes 20 years to make an overnight success. Perhaps now we might finally be able to acknowledge that the TCW investment process has become that “overnight success”…at least for now and until the next market crisis!

Disclosure

This material is for general information purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any security. Any issuers or securities noted in this document are provided as illustrations or examples only, for the limited purpose of analyzing general market or economic conditions and may not form the basis for an investment decision, nor are they intended to serve as investment advice. Any such issuers or securities are under periodic review by the portfolio management group and are subject to change without notice. TCW makes no representation as to whether any security or issuer mentioned in this document is now in any TCW portfolio. TCW, its officers, directors, employees or clients may have positions in securities or investments mentioned in this publication, which are subject to change without notice. Any information and statistical data contained herein derived from third party sources are believed to be reliable, but TCW does not represent that they are accurate, and they should not be relied on as such or be the basis for an investment decision. All information is as of the date of this presentation unless otherwise indicated.

An investment in the strategy described herein has risks, including the risk of losing some or all of the invested capital. An investor should carefully consider the risks and suitability of an investment strategy based on their own investment objectives and financial position. There is no assurance that the investment objectives and/or trends will come to pass or be maintained. The information contained herein may include preliminary information and/or “forward-looking statements.” Due to numerous factors, actual events may differ substantially from those presented herein. TCW assumes no duty to update any forward-looking statements or opinions in this document. This material comprises the assets under management of The TCW Group, Inc. and its subsidiaries, including TCW Investment Management Company LLC, TCW Asset Management Company LLC, and Metropolitan West Asset Management, LLC. Any opinions expressed herein are current only as of the time made and are subject to change without notice. The investment processes described herein are illustrative only and are subject to change. Past performance is no guarantee of future results. © 2025 TCW