Refi-Nation: Agency MBS Investing in a New Paradigm

“Most of the great problems we face are caused by politicians

creating solutions to the problems they created in the first place.”

– Walter E. Williams

Like doting parents incessantly waiting on a child’s every whim, central banks globally have coddled financial markets over the past decade to such an extent that independence has become seemingly impossible. While the Fed continues to make the magnanimous claim that its policies aim only to promote stability, it is increasingly apparent that “financial stability” has become nothing more than a euphemism for “higher prices.” In fact, the Fed’s playbook – the one-two punch of lowering rates (for longer) coupled with quantitative easing (to infinity) – is well worn, and its effects on broader risk-asset prices are well documented. For the U.S. mortgage market, however, a decade and more of government initiatives designed to broaden homeownership and mortgage credit availability has mixed with this era of monetary easing into a cocktail of disturbing developments for investors and borrowers alike, developments that have been thrust to the forefront in this most recent crisis. As we peek into the years ahead, we see a new paradigm for agency MBS investors. A market that once benefited those who would seek out value through deep fundamental analysis and security selection has been replaced by one dominated by technical forces and distorted by government intervention.

Since the global financial crisis (GFC), the U.S. agency mortgage market has been subject to a steady outpouring of government policies designed to broaden the availability of mortgage credit to consumers. These policies have included the Home Affordable Refinance Program (HARP) and the Home Affordable Modification Program (HAMP), designed to assist struggling homeowners in refinancing or modifying their mortgage in the face of the greatest recession in modern history. While these policies were well intentioned, they have paved the way for what could aptly be characterized as an era of publicly subsidized mortgage credit abundance, facilitated by relentless monetary stimulus ushered in by central banks. Today, we see a mortgage market that is largely controlled by pricing and policy decisions enforced by the federal government and the entities that it has created and expanded over the past century. Indeed, providing a further subsidized mortgage rate for all borrowers is the government’s new solution to address the problems first created through its efforts to promote affordable housing to lower income and underserved communities.

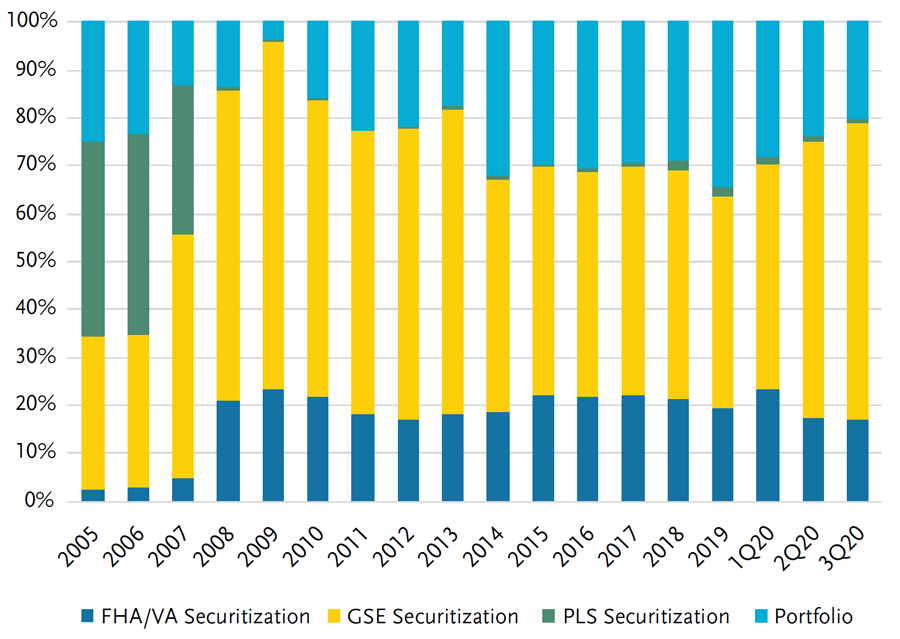

To see an example of this abundance in mortgage credit, we need only to look at the modern trajectory of Ginnie Mae securitized mortgage lending. In the years since the GFC, Ginnie Mae securitized loan origination via the Federal Housing Administration (FHA) and Veterans Administration (VA) has ballooned from playing a minor role in the mortgage market, accounting for less than 5% of annual originations, to become a sub-prime lending behemoth. Today, Ginnie Mae guarantees nearly a fifth of all single-family mortgages, backstopped by the U.S. taxpayer. This boom in FHA/VA lending was fueled largely by an aggressive opening of the credit box, made possible by top-down government policies intended to promote home affordability to the masses in an era of low and falling mortgage rates. More recently, this expansion of credit was married to novel streamlined refinancing programs with all the hallmarks of pre-GFC underwriting exuberance. Through these programs, some borrowers are able refinance with minimal documentation, no credit checks and no loan-to-value (LTV) ratio limits, further increasing the appeal of FHA/VA programs to credit-challenged borrowers.

Mortgage Origination by Channel: FHA/VA Share Has Risen Post GFC

Source: TCW, Morgan Stanley, Inside Mortgage Finance

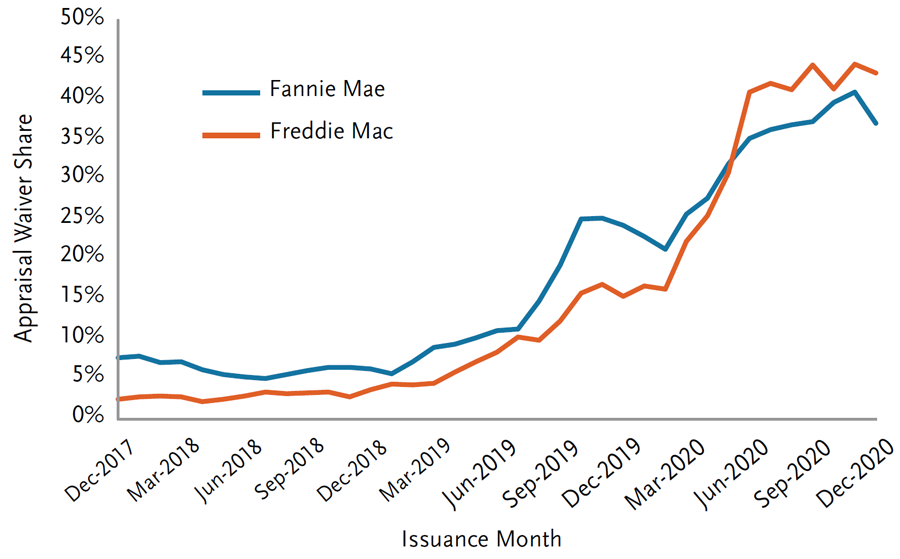

Conventional mortgage lending was similarly swept up in this period of plentiful credit and easy refinancing. Fannie Mae’s HomeReady and Freddie Mac’s Home Possible programs were groomed to compete with FHA lending, making low-interest mortgages available to low-income, first-time homebuyers for as little as 3% down. High-LTV refinancing programs replaced HARP, extending crisis-era policies to enable homeowners with little or no equity to refinance in an age of falling rates. However, perhaps most systemic in the post-GFC conventional mortgage landscape was the meteoric rise of Property Inspection Waivers (PIW). In a bid to bring mortgage lending into the 21st century, agencies began to automate the task of home appraisals: rather than demand a physical appraisal of a property, agencies instead rely on proprietary models in the valuation process, greatly expediting closings. Since PIWs were first introduced in late 2017, the share of 30-year conventional loans granted appraisal waivers has risen from less than 10% to over 40% today.

Apprasial Waivers Have Gained Wisespread Adoption

Source: TCW, Fannie Mae, Freddie Mac, eMBS, Nomura

This new landscape in mortgage lending was not missed by the private sector, which took these well-intentioned developments to their capitalistic extremes. As volume generally drives mortgage lender profitability, an expansion of mortgage credit availability coupled with the provision for streamlined refinancing in Ginnie Mae lending opened the door to rampant loan churning that resulted in absurd prepayment speeds for Ginnie investors. This abuse eventually forced regulators to step in, temporarily banning bad actors from pooling their loans into Ginnie Mae securitizations, but the damage was already done. Ginnie pools today continue to be plagued by prepayment speeds that are markedly faster than their conventional peers.

Similarly, in conventional mortgages, the prevalence of PIWs fueled the rapid ascent of non-bank mortgage lenders with business models built entirely on automation, speed and turnover. Flying the proud fintech banner, Quicken Loans and United Wholesale Mortgage have grown to become two of the three largest mortgage lenders the U.S., with a combined market share reaching 12% by Q3 2020. For mortgage investors, this is bad news. Ever-rising numbers of these “fintech originated” loans made their way into conventional mortgage pools, poisoning their collateral quality, polluting their prepayment characteristics, and establishing a new standard in agency MBS fundamentals.

In short, these government-sponsored programs and policies, which modify loan rates down for all government and agency guaranteed mortgages at little to no cost to borrowers, are tantamount to an all-encompassing “Refi.gov” policy in all but name. Once thought of as an appropriate response in the aftermath of the GFC, “Refi.gov” never became policy in its own right; however, policies enacted since then have all the trappings of this indiscriminate “low mortgage rates for all” initiative – a “Refi-Nation” has emerged.

This initiative to expand mortgage credit availability, and its ill effects, came to a head in the still unresolved COVID-19 crisis. With a swift stroke of the pen, Congress authorized widespread mortgage forbearance for homeowners while the Fed slashed rates to zero and initiated QE4, the most aggressive asset purchasing program to date. For mortgage investors, these actions coalesced into a buyout1 and refinance wave that fundamentally changed the nature and valuation of the agency mortgage market, cleaving a seemingly impassable rift in performance between agency mortgage pools and TBAs2. While agency MBS pools floundered in a tsunami-like prepayment wave – as COVID-19 policy responses further enabled “Refi-Nation”– mortgage fundamentals deteriorated from increased prepayment risks that lay in stark contrast to the favorable technicals in the TBA market. Relentless Fed buying resulted in agency MBS spreads rallying back towards historic tights, cleaned up the deliverable float in production coupons3, and contributed to persistently high levels of TBA roll specialness4. For agency MBS investors, with specified pool payups to TBA prices at historically rich levels, the fundamental spread and yield performance that could be gained from security selection has paled in comparison to the excess carry that could be more consistently earned in the TBA market.

While it is far too early to declare victory over the COVID-19 crisis, as the first vaccines begin to be administered around the world, we must ponder the state of the agency MBS market that will greet us on the other side. Indeed, the pandemic of faster prepayment speeds – made possible by the systemic easing in mortgage credit – may likely continue to worsen, driving a potentially persistent bifurcation in agency MBS fundamentals and technicals.

Just as COVID-19 restrictions drove unprecedented transformations in consumer demand and forced businesses to reposition, fast-forwarding the birth of the “2030 economy,” the primary mortgage market would see similarly permanent disruptions. For one, appraisal waivers, automated property valuation models, virtual showings, and remote closings would certainly all be commonplace. As banks and more traditional lenders continue to see their market share eroded by more nimble non-bank players, they must inevitability defend their businesses, driving the further development and integration of novel mortgage underwriting technologies. No doubt, as the adoption of these technologies becomes widespread – their use facilitated by accommodative lending programs – mortgage underwriting efficiency would only continue to improve, resulting in faster baseline prepayment speeds for agency MBS investors.

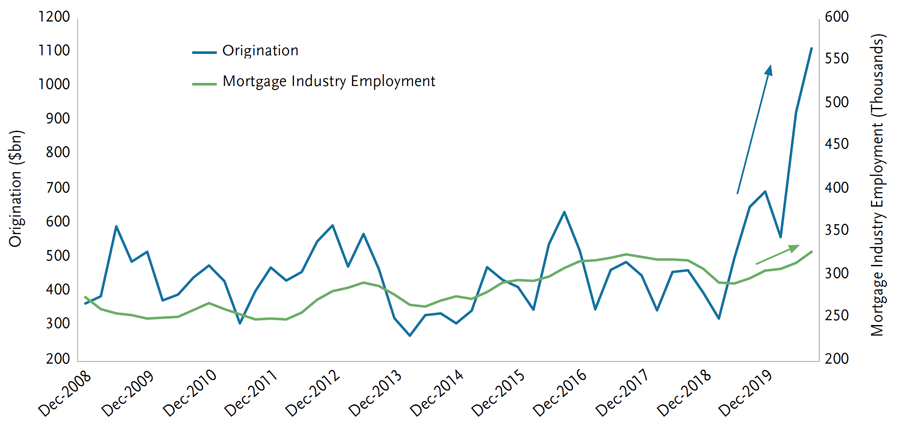

Efficiency Continues to Rise: Origination Versus Mortgage Industry Employment

Source: TCW, JP Morgan, MBA, BLS

At the same time, policy responses are expected to support this new paradigm at every turn. With the incoming administration’s progressive bent, it is probable that the great post-GFC easing in mortgage credit would be further expanded to support previously underserved borrowers. Meanwhile, the Fed firmly maintains its “lower for longer” stance on rates and vows to keep asset purchases at their current pace, likely continuing to suppress mortgage rates. As the central tenet of asset pricing dictates, as discount rates fall, asset prices – whether stocks or homes – rise. While these policies are inclined to promote higher home prices and a vibrant primary mortgage market, they continue to widen the schism between the haves and have-nots, a circumstance echoed by the distinctly “K-shaped” recovery we have observed. Ironically, for the goal of greater housing affordability, the expansion of government-sponsored mortgage lending programs may well be the primary force sabotaging its success. It is not outrageous to assert that the policies instituted over the past decade by the government and Fed alike have exacerbated the very wealth inequality they profess to combat. Surely, we can once again depend on the government for another “solution” to this “K-shaped” recovery in the years to come.

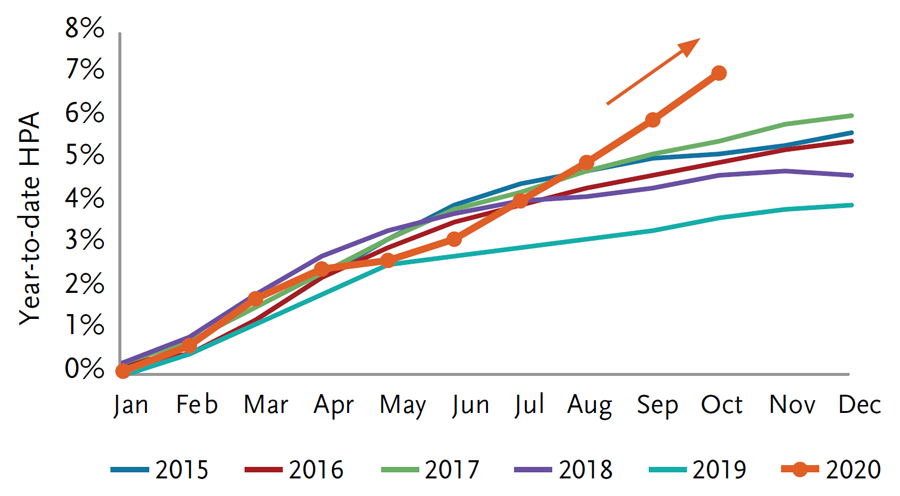

Home Prices Have Risen the Fastest Since 2015…

Source: TCW, Nomura, CoreLogic

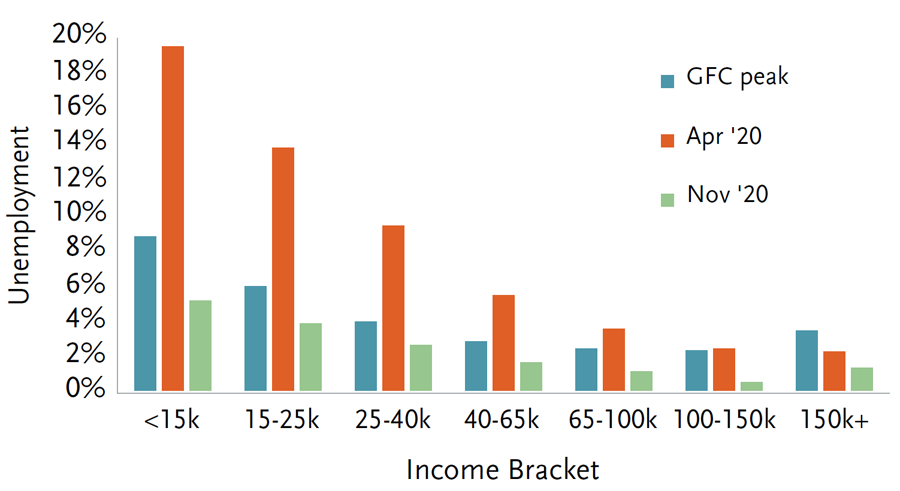

...While the Lowest Income Brackets Have Suffered the Most

Source: TCW, Nomura, Current Population Survey

Just as bond investors must adapt to the “new” normal of zero interest rates, mortgage investors today must contend with “Refi-Nation.” As the COVID-19 crisis spurs on the forces that continue to fast-track adoption of the “2030 economy,” it would seem that we are standing on the precipice of a new paradigm in agency MBS investing. Without structural changes to government-supported mortgage lending, it is possible that the prevalent unhealthy dichotomy between poor agency MBS fundamentals and strong technicals would continue to grow – perhaps to the point where entire swaths of the agency MBS market, beyond the warm embrace of the Fed, may become largely uninvestable. Nonetheless, as we have seen in the decade past, it would seem that change is truly the only constant. “Alpha” in mortgage investing would inevitably take on a fundamentally different form in the decade to come.

1 Ginnie Mae servicers and GSEs have the option to buy out delinquent loans from agency MBS pools, resulting in prepayments for the agency MBS investor. Because investors get back par on the portion of the pool that is bought out, current investors stand to lose significant yield and total return on agency MBS pools as the average price of a pool is over 105% of par.

2 To be announced (TBA) contracts are over-the-counter forward contracts used to purchase and sell agency MBS pass-throughs on future settlement dates.

3 Agency MBS pass-throughs with coupons actively originated based on the prevailing primary mortgage rate. The Fed purchases these pass-throughs through the TBA market and they are typically the “worst-to-deliver,” having the worst prepayment profiles. This “cleans up” the remaining float for other investors to buy.

4 An increase in the prices of current month versus back month pools delivered in the TBA market, providing additional carry for investors who remain long TBA contracts.

Disclosure

This material is for general information purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any security. TCW, its officers, directors, employees or clients may have positions in securities or investments mentioned in this publication, which positions may change at any time, without notice. While the information and statistical data contained herein are based on sources believed to be reliable, we do not represent that it is accurate and should not be relied on as such or be the basis for an investment decision. The information contained herein may include preliminary information and/or "forward-looking statements." Due to numerous factors, actual events may differ substantially from those presented. TCW assumes no duty to update any forward-looking statements or opinions in this document. Any opinions expressed herein are current only as of the time made and are subject to change without notice. Past performance is no guarantee of future results. © 2025 TCW